Fraud is a crime that involves deception in order to earn financial or personal advantage from an individual, business, or organisation. There are numerous methods for a person or company to become the victim of fraud. Debit card frauds, identity theft, advanced fee fraud is some of the common examples on how a person becomes a victim. On the other hand, businesses may become victims of what is known as occupational fraud.

According to the PwC Global Economic Crime and Fraud Survey 2020, 42% of Singapore-based businesses experienced fraud in the previous 24 months, compared to 47% globally. The majority (54%) of Singapore-based firms reporting fraud (compared to 36% globally) stated that the total direct financial impact of economic crime suffered exceeded USD 1 million. Nearly a quarter (23%) of Singapore-based respondents (compared to 13% globally) indicated that their losses exceeded USD 50 million.

According to The Association of Certified Fraud Examiners (ACFE), occupational fraud falls into three categories:

- Asset misappropriation – This occurs when an employee steals or abuses the company’s resources.

- Corruption – When an employee abuses their power in business deals to benefit themselves or a third party (such as their spouse, kids, or friends), which also involves accepting or paying bribes in exchange for good business judgement.

- Financial statement fraud – Deliberate distortion of a company’s financial data in order to deceive creditors, investors, or government officials.

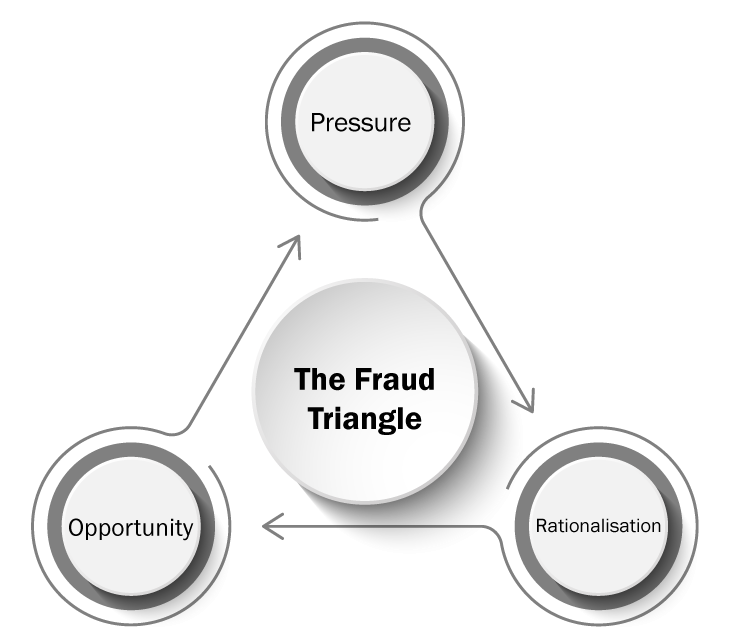

Fraudsters engage in this illegal activity for various reasons. ‘The Fraud Triangle’, developed by Dr. Donald Cressey, states that there are three conditions that must be met in order for occupational fraud to occur. These conditions are:

- Pressure – Financial difficulties are frequently what lead offenders to perpetrate fraud.

- Rationalisation – Offenders would attempt to rationalise their illicit behaviour to convince themselves that they deserved the additional remuneration and to keep a positive self-image.

- Opportunity – When fraudsters discover the right moment or window to carry out their scheme successfully. This opportunity could be due to the absence of anti-fraud controls.

In order to protect the businesses, there are steps that business or company owners could do to prevent themselves from being a victim of occupational fraud; which is by implementing anti-fraud controls. Report to the Nations suggested that there are six anti-fraud controls which associated with lower fraud losses which are:

- An established, company-wide code of conduct

- An internal audit department

- Management certification of financial statements

- External audit of internal controls over financial reporting

- Management review

- Hotlines

Fraud is a serious crime that society has to face and it can leave devastating effects on the victims as well as the economy. This is why Comeandsee Global offers Fraud Risk course for you to better educate yourself and to stay vigilant, sign up here now!

Sources: